Telemarketing has become a major issue affecting consumer privacy around the world. These problems are not just annoyances, but also have impacts across many dimensions that cause trouble for society. The main problem is that telemarketing interferes with consumers' privacy rights. An Australian study found that 56% of telemarketing call recipients see these calls as a frequent problem. Among those who receive marketing calls daily, up to 84% consider it a serious problem. In our daily lives, we encounter this kind of issue, and most people see it as a violation of their right to privacy. Clear examples include banks calling to offer credit cards, or "Call Center Gangs" who call to offer goods or services—these may be fraudsters who do not actually have the goods or services they claim to offer, but instead deceive consumers into giving them money.

These issues illustrate the need for mechanisms to protect consumers' rights to privacy while balancing the freedom of commercial speech and individuals' privacy rights. This article explores the legal mechanisms that address these issues—specifically the Do Not Call Registry—and examines the laws related to privacy rights protection in Thailand as they relate to direct marketing.

Telemarketing is defined by the Federal Trade Commission (FTC) of the United States in its Telemarketing Sales Rule as “a plan, program, or campaign…to induce the purchase of goods or services or a charitable contribution.” Therefore, telemarketing can be thought of as a direct marketing tool or process that uses the telephone as a medium. People who engage in direct telemarketing must follow the Telemarketing Sales Rule, even for calls from outside the U.S., as long as the call is aimed at inducing U.S. consumers to make purchases. Three important parties are involved in telemarketing: the seller, the telemarketer, and the customer/consumer.

Generally, inbound calls are not considered telemarketing because the seller does not initiate the call to offer goods or services. Therefore, inbound calls, such as hotel or airline reservations and calls to inquire about information, are not subject to the regulations of the Telemarketing Sales Rule (except for upselling).

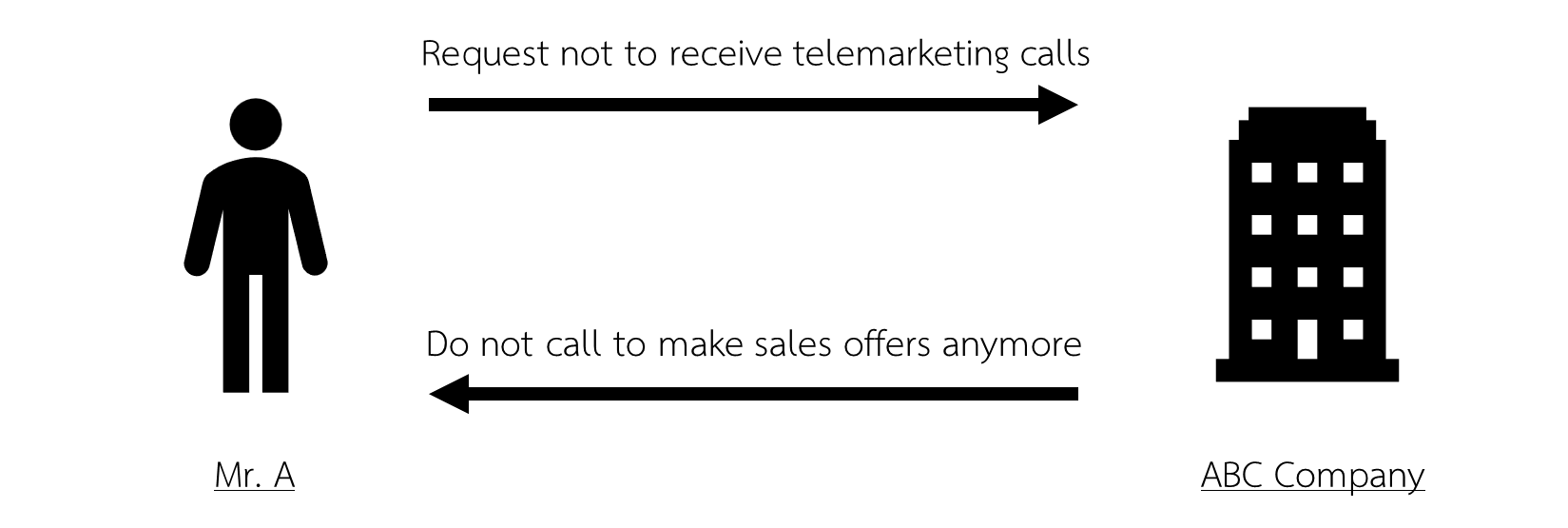

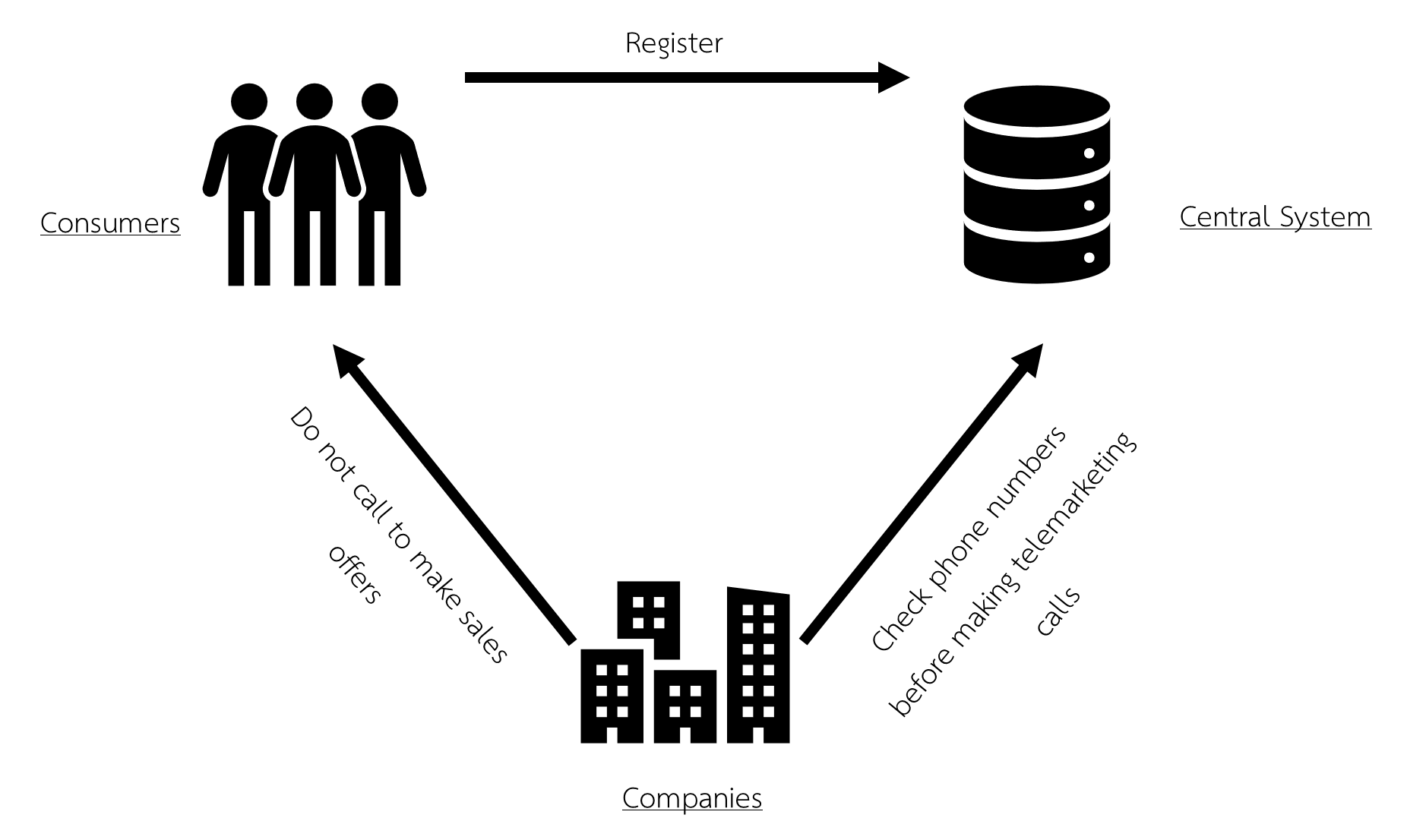

Initially, the Telemarketing Sales Rule only stipulated an Entity-Specific Do Not Call Registry, which prohibited sellers from calling any consumer who had requested not to receive calls from that particular company. Later, in 2003, the Federal Trade Commission (FTC) updated the regulations by adding the National Do Not Call Registry, a centralized system that allows people who do not want to receive marketing calls to register their phone numbers in a national database and enable businesses to check these phone numbers This new system was developed with the expectation that it would provide more effective protection for consumers' privacy rights. The system currently has more than 221 million registered phone numbers, demonstrating the widespread response from consumers in the U.S.

Entity-specific Do Not Call

National Do Not Call Registry.

The Rule requires sellers and telemarketers not to call consumers whose phone numbers are listed in the database. Violation of the Rule may result in penalties. However, this requirement does not apply to calls from political organizations, charities, telephone surveyors, or companies with which consumers already have an existing business relationship, including business-to-business (B2B) relationships.

The customer called to inquire about the product with the company. If the company calls back within 3 months from the date of the customer's inquiry, regardless of whether the customer's phone number is on the Do Not Call list or not, the company can call back. However, after 3 months, the company can only call the client if (1) the client expressly consents to the call, or (2) there is an existing business relationship.

In Singapore, there is a National Do Not Call Registry as part of Singapore's Personal Data Protection Act. The Act was expanded to include SMS, MMS, and fax messages, as well as marketing messages through applications such as WhatsApp. However, operators can only make calls if the consumer has consented or if they meet the conditions of various exceptions.

The basic principle of the National Do Not Call Registry is that it functions as an opt-out tool. It is a centralized system that allows sellers or telemarketers to check the registered phone number.

Although there is no National Do Not Call Registry in Thailand, which is a centralized system for consumers to register their phone numbers like in Singapore, the United States, and many other countries, financial institution businesses have prepared their own Do Not Call Lists, which are entity-specific. In Notification of the Bank of Thailand No. SorGorSor. 2/2563, many people may have found that financial institutions or companies that operate credit card businesses call to offer financial products such as credit cards or life insurance. The caller will introduce himself or herself, identify who they are and where they come from, as well as provide the channels through which consumers can decline the offering. This is the Do Not Call List of financial institutions.

One of the criteria under the Bank of Thailand's notification is that customers must receive offerings that do not interfere with their privacy. Financial institutions or companies engaged in the credit card business must maintain a Do Not Call List, and the list must be updated at all times. In addition, customers must be clearly informed that they have the right to choose not to be contacted again, and they must also be informed of the channel through which to opt out of future contact. In the event that customers do not wish to be contacted, this must be implemented without delay, except in the case of contact initiated by the customer (inbound call) when customers wish to receive offers for products they have requested. In this case, there is no need to notify them of the right not to be contacted.

When a customer specifically requests contact regarding Product A, the service provider may call back to offer that particular product without notifying the customer of the Do Not Call option. Nevertheless, if the service provider attempts to market any products beyond the originally requested Product A, they are required to notify the customer of their Do Not Call rights.

This characteristic represents one method of marketing, namely a form of direct marketing because it involves personalized communication through telephone calls. The law considers this important because it may involve using personal data in a way that invades privacy, and the general public does not expect to be contacted without request. Therefore, the Personal Data Protection Act stipulates that direct marketing must primarily rely on the basis of consent. Organizations that conduct direct marketing through telemarketing need to consider the conditions of consent as required by law, including:

Therefore, entrepreneurs must clearly evaluate and distinguish which cases rely on a contractual basis and which cases require a basis of consent.

In this case, the collection, use, or processing of any personal data for direct marketing purposes requires a basis of consent. Entrepreneurs must obtain customer consent to collect contact information before offering products or services for sale. They may design consent forms to categorize sales offer channels so customers have the opportunity to choose to receive offers through their preferred channels. For example, customers may prefer receiving offers via email rather than telephone. This way, organizations have more opportunities to market through other channels. In addition, entrepreneurs must consider making the channels for exercising the right to withdraw consent are as convenient as when giving consent.

In conclusion, telemarketing is a direct marketing activity that creates both business opportunities and widespread annoyance for consumers. The Do Not Call Registry is therefore an important mechanism for protecting privacy rights by allowing consumers to use opt-out rights to refuse commercial contact. Many countries such as the United States and Singapore have developed this system in a centralized format for people to register with the government and for business to access those lists. While Thailand currently does not have such a centralized system, Entity-Specific Do Not Call Lists have been established for financial institution businesses according to Bank of Thailand guidelines.

However, telemarketing may still create annoyance or interfere with privacy rights. Important issues that agencies need to consider can be divided into two main parts: